Reduce mortgage term calculator

Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. Longer-term lengths will reduce your monthly payment but youll pay more interest over time.

Mortgage With Extra Payments Calculator

Buy a home in a neighborhood with expensive HOA fees.

. Choose a longer-term mortgage like a 30-year rather than a 15-year loan. This calculator will calculate the monthly payment and interest costs for up to 3 loans -- all on one screen -- for comparison purposes. If you have a 30-year mortgage you can refinance to a 15-year mortgage with reduced interest.

Paying an extra 1000 per month would save a homeowner a staggering 320000 in interest and nearly cut the mortgage term in half. The final payment of a Balloon Mortgage is very large compared to the previous payments. Term and Interest rate.

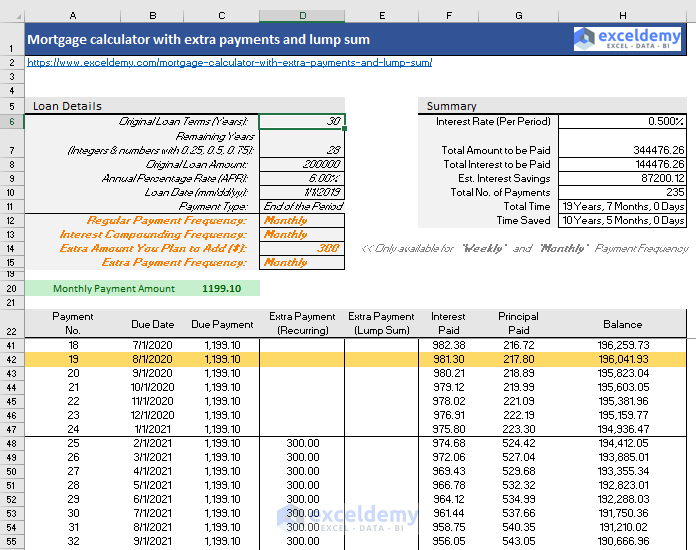

Put 20 down or as much as you can for your down payment. Extend the term the number of years it will take to pay off the loan. The above calculator supports recurring weekly biweekly monthly quarterly or annual payments along with one-off lump sum contributions.

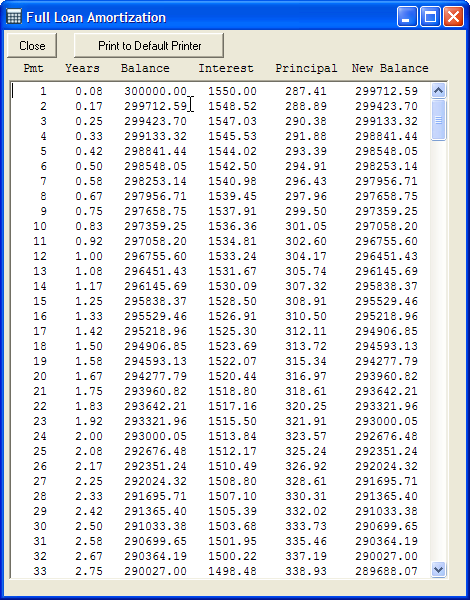

Or view two different loan amounts that carry the same interest rate and repayment period. Principal Years Start month Start year Interest o oo ooo 18 Payment Year Year Summary. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

Is approaching 400000 and interest rates are hovering around 3. To decide what the best loan term is Mortgages are commonly offered with either 15 or 30-year terms. This mortgage comparison calculator compares loans with different mortgage rates loan amounts or terms.

Comparing loan features side by side helps you find the mortgage loan you need. A Balloon Mortgage allows you to pay smaller payments throughout the time of the mortgage although it results in a larger balance once the mortgage has matured. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest.

Choose a term and interest rate that best suits your needs and your timeline. A mortgage calculator can help you decide whether you should. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way.

To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. Free VA mortgage calculator to find the monthly payment total interest funding fee and amortization details of a VA loan or to learn more about VA loans. Our mortgage overpayment calculator uses the standard.

A Balloon Mortgage does not reduce over the chosen term of the mortgage. The mortgage calculator lets you test scenarios to see how you can reduce the monthly payments. How much can I borrow.

Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. The calculator assumes that your monthly overpayments will be the same every month for the rest of the mortgage term. It takes about five to ten minutes.

How to estimate mortgage payments. If you make higher overpayments you can further shorten your loan term and reduce your interest costs. Affordability calculator get a more accurate estimate of how much you could borrow from us.

Our calculator is for demonstration only and should not be relied upon as an absolute figure. To be more precise itd shave nearly 12. Based on a 200000 mortgage at a fixed 3 APR you can save over 5000 if you make an overpayment of 50 per month.

Offset calculator see how much you could save. You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. It will also remove more than 1 year off a 25-year mortgage term.

To calculate the payment amount and the total interest of any fixed term loan simply fill in the 3 left-hand cells of the first row and then click on Compute. Extend the term the number of years it will take to pay off the loan. Depending on the price of your home a mortgage calculator can help you figure out what the best down payment will be.

Making prepayments can potentially shorten the loan term and reduce the interest payments. Moreover it allows you to shift from a fixed-rate mortgage to. Likewise if you keep making extra monthly mortgage payments this will further reduce your term and interest charges.

Buy in an area with high property taxes. This is the purchase price minus your down payment. The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments.

Mortgage Amount or current balance. Try to avoid PMI private mortgage insurance if you can. Make a larger down payment to get a lower payment.

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Choose a shorter term to pay off your loan faster. Improve your credit score.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. Consider this example if you want to maximise your savings. In the More Options input section of the calculator is an Extra Payments section to input.

Use this large fund to shorten your mortgage term and diminish your interest costs. The mortgage calculator lets you test scenarios to see how you can reduce the monthly payments. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US.

Making an overpayment will reduce the amount of interest you are charged. Make a larger down payment to reduce your monthly PMI amount. Try different scenarios on our mortgage calculator but some ways to reduce your mortgage payment are as follows.

Compare two fixed rate loans with different rates repayment periods.

Extra Payment Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator How Much Monthly Payments Will Cost

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Loan Calculator Mortgage Comparison Mortgage Estimator

Compare 30 Vs 15 Year Mortgage Calculator Mls Mortgage Amortization Schedule Mortgage Calculator Mortgage Rates

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

Amortization Schedule Calculator Amortization Schedule Mortgage Payoff Pay Off Mortgage Early

Mortgage Calculator How Much Monthly Payments Will Cost

Downloadable Free Mortgage Calculator Tool

Budget Calculator Budget Planner Mls Mortgage Budget Calculator Budgeting Amortization Schedule

Friendly Finance Loan Calculator Finance Loans Calculator Loan Calculator

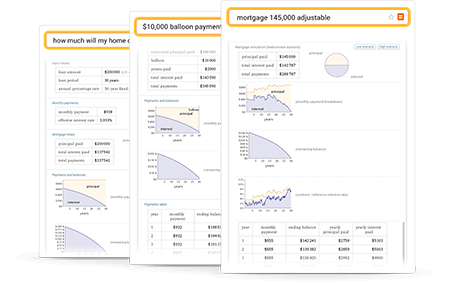

Online Mortgage Calculator Wolfram Alpha

Mortgage Calculator With Down Payment Dates And Points

Flat Interest Rate Vs Reducing Balance Rate Types Of Loans Interest Rates Interest Calculator

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator